We all spend our time watching the Federal Reserve. We analyze every speech, dissect every comma in their statements, and hold our breath for every interest rate decision. We treat the Fed like the master architect of our economic destiny, the sole entity with its hands on the levers of our financial lives.

But what if I told you we’re all looking at the wrong screen?

What if there’s another, more elemental force at play—a hidden current running deep beneath the surface of the global economy that has a profound, almost primal, influence on the cost of everything? It’s not a committee in a boardroom; it’s a pumpjack in a Texas field and a supertanker gliding across the ocean. It’s the price of oil. And right now, it’s whispering a story about the future that almost no one is hearing.

When I first saw the chart market veteran Ed Yardeni flagged, connecting the price of crude oil to the 10-year Treasury yield, I honestly just sat back in my chair, a little stunned. It’s the kind of elegant, simple correlation that makes you feel like you’ve just been shown a secret schematic of the world—the idea that Oil Prices Are Falling. That Could Mean Lower Borrowing Costs. For years, we’ve treated these two metrics as distant cousins. Turns out, they’re practically twins, moving in a silent, powerful dance. And that dance is about to change the music for all of us.

The Invisible Engine of Everything

Let’s break this down. The 10-year Treasury yield is, for all intents and purposes, the base code for the cost of money in America. It’s the foundational interest rate that determines how much you’ll pay for a mortgage, how much a business will pay to expand, and how much a startup will pay to fund a world-changing idea. This is the economy’s operating system—in simpler terms, it's the baseline price of a dream. When it goes up, dreams get more expensive. When it goes down, they get cheaper.

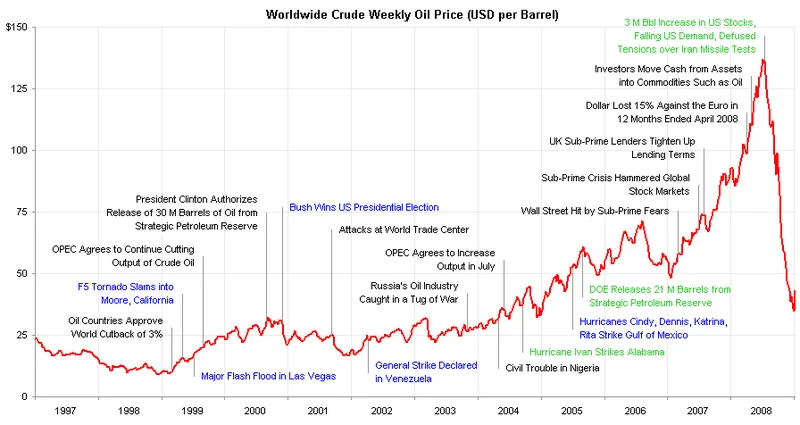

For the better part of a year, that price has been stubbornly high. But now, something is shifting. Oil prices have been tumbling, hitting lows we haven't seen in nearly five years. A cocktail of factors—booming U.S. production that has turned us into an energy powerhouse, a nervous global market worried about trade, and increased output from OPEC+—has sent crude into a nosedive. US crude is down a staggering 18% this year.

And because of that secret dance, the 10-year Treasury yield is following it down. Yardeni predicts the yield could fall below 4.00%, maybe even to 3.75%. That might not sound like much, but in the vast machine of the global economy, it’s a tectonic shift. It’s like discovering a massive, untapped reservoir of energy that can suddenly power our ambitions more cheaply and efficiently than ever before. This is the kind of breakthrough that reminds me why I got into this field in the first place—the realization that deep within the complex systems we've built, there are still beautifully simple levers that can unlock immense human potential.

What does this actually mean for you, for me, for us? Imagine a young couple, hunched over a laptop at their kitchen table at 11 PM, plugging numbers into a mortgage calculator. For months, the result has been the same: a soul-crushing monthly payment that puts their dream home just out of reach. But tonight, they plug in the new numbers reflecting a lower rate. The screen refreshes. The monthly payment drops by hundreds of dollars. Suddenly, the impossible feels possible. Their shoulders relax, and for the first time in a long time, they look at each other and smile a genuine, hopeful smile. That’s not just a data point; that’s a life changed.

A New Renaissance Fueled by Cheaper Capital

This isn’t just about mortgages. This is about the cost of innovation itself. Every great leap forward in human history was preceded by a drop in the cost of a key ingredient. The printing press made the distribution of knowledge radically cheaper, sparking the Renaissance. The Bessemer process made steel cheap, giving us skyscrapers and modern cities. The microchip made computation cheap, giving us the digital world we now inhabit.

We may be standing at the precipice of a similar moment, only this time the key ingredient is capital.

Think about the sheer, breathtaking amount of innovation happening right now—in AI, in biotech, in sustainable energy, in space exploration—and all of it has been happening in a high-interest-rate environment where money is expensive and investors are cautious. The speed of this is just staggering—it means the gap between a brilliant idea and a world-changing reality is being bridged by sheer force of will, but imagine what happens when we grease the wheels. What happens when the cost of funding that next AI model, that gene-editing therapy, or that fusion reactor project suddenly drops?

This is the question that should be keeping us all up at night, not with worry, but with a profound sense of excitement. How many incredible ideas are currently sitting on whiteboards or in notebooks, dismissed as "too expensive" or "too risky" in the current climate? A sustained drop in the cost of capital could unleash a wave of creativity and construction unlike anything we’ve seen in a generation. It’s a direct injection of fuel into the engine of human progress.

Of course, with this opportunity comes a profound responsibility. Cheaper capital doesn’t automatically mean better choices. We could use it to build more of the same, or we could use it to build the future we actually want—a future that is more sustainable, more equitable, and more inspiring. The choice, as always, will be ours. But for the first time in a long while, the math is starting to bend in favor of the bold. Are we ready to seize it? What will we choose to build?