Generated Title: Marvell's AI Hype Train: All Aboard, or Time to Jump Off?

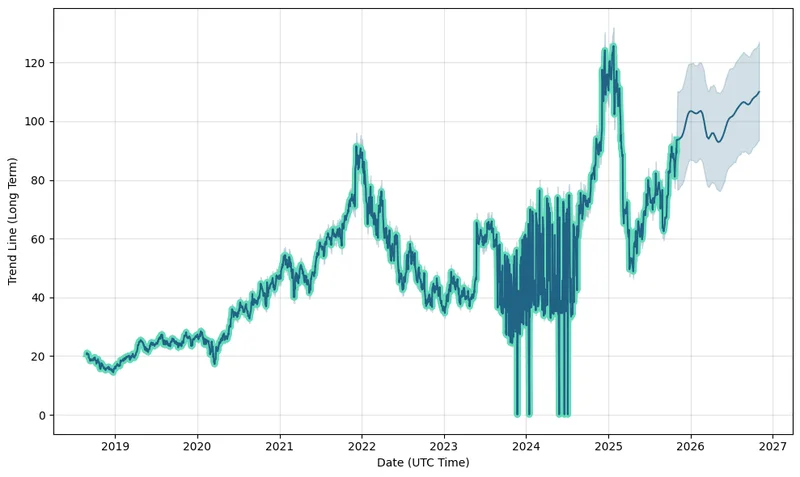

Okay, let's talk Marvell. The narrative is simple: AI, AI, AI. They're riding the wave, Amazon's a key partner, and the stock should be going gangbusters. But the stock's down 17% YTD? Something doesn't quite add up. Time to dig in.

The Amazon Effect: Real or Mirage?

The immediate catalyst for the recent bump is Amazon's talk about their Trainium chips, built by Marvell. Jassy claims Trainium2 is a "multibillion-dollar business," growing 150% quarter-over-quarter. Those are eye-popping numbers. And J.P. Morgan's Harlan Sur is singing Marvell's praises, slapping a $120 price target on the stock.

But let's pump the brakes. A single client, even one as massive as Amazon, shouldn't dictate the entire narrative. The reports mention Amazon’s capital expenditure forecast rose to $125 billion for 2025. How much of that goes directly to Marvell? The article doesn't specify. We're left to assume a proportional benefit, which is dangerous. It's like saying because someone bought a lottery ticket, they're guaranteed to win.

Marvell's CEO, Matt Murphy, is also pushing the diversification angle, claiming over 20 "multigenerational custom design wins" representing $75 billion in lifetime revenue. That's a big number, but "lifetime revenue potential" is doing a lot of heavy lifting there. How much of that is guaranteed revenue? How much is contingent on future performance, market conditions, or even just the client not going bankrupt?

Beyond Amazon: The Underlying Business

The Inphi acquisition in 2021 is consistently touted as a major win, growing from $600 million to $3 billion in revenue. That's impressive growth, no doubt. But what's the profit margin on that revenue? Are they just selling a ton of low-margin components, or are they actually generating significant profit? This is the part of the report that I find genuinely puzzling.

And then there's the switching business. Doubled since the Innovium acquisition, with potential to triple. Okay, but from what baseline? We’re told it started as a $150 million baseline when acquiring Innovium, so now it’s $300 million (projected to be $450 million). That's growth, sure, but is it explosive, game-changing growth that justifies the AI hype? I'm not convinced.

Marvell's operating margins are expanding – up 870 basis points year-over-year to 34.8%. EPS grew 123% in fiscal Q2, more than double revenue growth. These numbers are more like it. But can they sustain that kind of growth? The article mentions analysts expect revenue to increase from $5.77 billion in fiscal 2025 to $16 billion in fiscal 2030. That's a compound annual growth rate (CAGR) of roughly 18.6%. Respectable, but not exactly the stuff of hypergrowth AI companies.

Speaking of analysts, they're all over the place. 22 "Strong Buy" ratings, but also 10 "Hold" ratings. The average price target is only slightly above the current price. That suggests a lack of conviction.

The potential SoftBank takeover (reportedly valued between $80 billion and $100 billion) is interesting, but it's just talk. These deals fall apart all the time. As reported by TipRanks, Marvell (MRVL) Jumps 8% as SoftBank’s (SFTBY) $100B Takeover Talks Resurface.

Is This Just a Case of Irrational Exuberance?

Marvell's stock is trading at a forward earnings multiple of 30.6x, higher than its 10-year average of 27x. If it reverts to its historical average, the stock could surge 100% in four years. But that "if" is doing a lot of work. The market could just as easily decide that 30.6x is still too high, especially if growth slows down.

And let's not forget the broader market context. Marvell dipped more than the S&P 500, the Dow, and the Nasdaq on a recent trading day. That suggests the stock is more sensitive to negative news than its peers. Marvell Technology (MRVL) Sees a More Significant Dip Than Broader Market: Some Facts to Know, according to Yahoo Finance.

This is a Classic Case of "Show Me The Money"

Marvell is in a hot sector, partnering with a giant, and showing some promising growth. But the data feels…incomplete. Too much reliance on potential, not enough on concrete results. The diversification story needs more proof, the profit margins need more scrutiny, and the analyst consensus needs more conviction. Until then, I'm staying on the sidelines.